how to lower property taxes in nj

250 property tax deduction for senior citizens and disabled persons. 7 Steps to Appealand Win By Stephanie Booth.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Active military service property tax deferment.

. Basic homestead rebate or credit. The exact property tax levied depends on the county in New Jersey the property is located in. The base year will not change unless your property tax amount is less than the base year.

As Governor I will lower your property taxes through comprehensive reform of our broken school funding formula a system where 60 of state aid goes to just 5 of the districts is unsustainable Jack. Click here for application. As one example property taxes could be reduced by over 8 simply by aligning public employee health benefits and retirement savings plans to what the rest of New Jerseyans feel lucky to receive from their employers.

The General Tax Rate is used to calculate the tax assessed on a property. If these three ratios are not between 0 and 1 then divide them by 100. If you want to receive a veteran property tax deduction you need to.

The measure would change the deduction for rent payments considered as property taxes from 18 to 30. Check If You Qualify For 3708 StimuIus Check. You will always compare your base year to your current year property tax amount.

And this week it came to light that Kevin Corbett the head of NJ Transit was also a beneficiary of the program cutting his tax bill on. Phil Murphys signed bill. Ad 2022 Latest Homeowners Relief Program.

Here are five interventions to cut spending and reduce property taxes. As a result of the ratification of Assembly Bill 4457 all 2020 property tax appeals are accepted by September 30 rather than July 1. Short of moving to a smaller home or another state appealing the assessment of a property is how homeowners can lower their tax bills said Anthony DellaPelle a partner at McKirdy Riskin Olson.

Hunterdon County collects the highest property tax in New Jersey levying an average of 852300 191 of median home value yearly in property taxes while Cumberland County has the lowest property tax in the state collecting an average tax of 374400 213 of median. Tax refund ahead sign. NJ Veterans Property Tax Exemption.

ChokkicxDigitalVision VectorsGetty Images 21 states offer what is known as a circuit breaker tax credit. It allowed us to create a login and enter the evidence including. If the current year is higher you get the difference as your reimbursement.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Be a legal resident of New Jersey. How can I lower my property taxes in NJ.

ACH is now available. It is equal to 10 per 1000 of taxable assessed value. New Jersey property tax bills and appeals must adhere to deadlines under Gov.

830 am - 430 pm Monday - Friday. Below is a summary of the chief programs in New Jersey. The taxing authorities multiply the taxable value of a home by the tax rate to arrive at the tax owed.

Find the three tax ratios for your city. Lower property taxes to make home ownership more affordable New Jersey can and should be a place where our residents can afford to live and work for generations. And if you live in a high-tax stateNew Jersey Illinois and Texas.

The general tax rate is used to compute the tax on a property. Have active duty service in the US. For example if your tax ratios are 2486 2925 and 3364 then divide them by 100 to get 2486 2925 and 3364 Now they are between.

Your county tax board can adjust this percentage figure which is also known as the assessment ratio. New Jersey voters tried unsuccessfully in 1981 in 1983 and again in 1986 to. Check Your Eligibility Today.

Rasmussen said the average New Jersey renter who pays 1500 per month 18000 annually in rent would be able to deduct 2100 more than they would under current law. Here are the programs that can help you lower property taxes in NJ. On the towns website we quickly found the link to enter an online appeal with the countys board of taxation.

So if your property is assessed at 300000 and. Go to the New Jersey Division of Taxation website through the link in the References section. Imagine that the taxable value of your home is 300000 and the tax rate is 10 for every 1000 of taxable value.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. Filing the appeal.

The effective tax rate isnt used to calculate property tax. Want to Lower Your Property Taxes. The standard measure of property value is true value or market value that is what a willing knowledgeable buyer would pay a.

Property Tax in New Jersey. Click on your county. The Effective Tax Rate is used to compare one district to another.

100 disabled veteran property tax exemption. Many New Jersey homeowners are entitled to a rebate or credit thats a percentage of the first 10000 in property tax that they paid last year. The percentage depends on the owners annual income.

Armed Forces with an honorable discharge. Tax Account InquiryPrint a Tax Bill. New Jerseys real property tax is an ad valorem tax or a tax according to value.

Give power back to the people of New Jersey. New Jersey allows for reduced property taxes if you meet certain requirements. These are designed to provide relief to homeowners who are paying a large portion of their income to property tax by capping your tax bill at a certain percentage of your income.

New Jersey doesnt have to continue to be the butt of jokes and derision by the leaders of more fiscally disciplined states. 250 veteran property tax deduction.

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State 2017 Eye On Housing

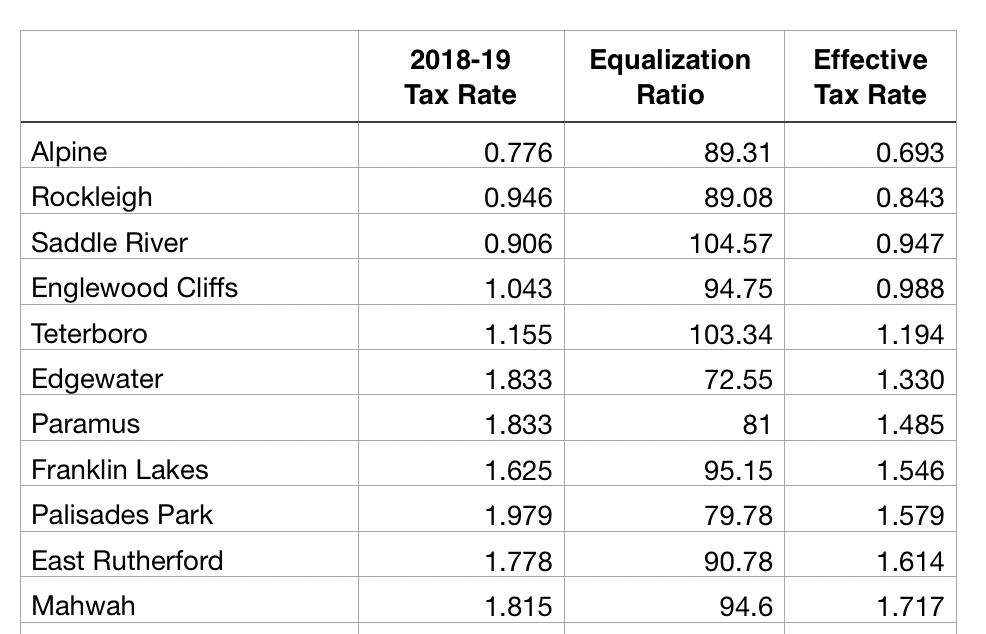

Bergen County Tax Rates For 2018 2019 Michael Shetler

How To Cut Your Property Taxes Credit Com

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Tax Lawyer

Who Determines Property Taxes Infographic Infographic Property Tax Investment Property

Lowest Highest Taxed States H R Block Blog Infographic City High School Classroom

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Deducting Property Taxes H R Block

Index Of Informative Paper Spinners The Borrowers

Florida Property Tax H R Block

The Ten Lowest Property Tax Towns In Nj